For years, the Reserve Bank of Australia (RBA) have been patting themselves on the back for keeping inflation and interest rates low. What if, in actuality, the likes of Bill Clinton and Boris Yeltsin played a bigger role in keeping inflation low than our own central bank? This article examines the big-picture events that have driven global inflation and interest rates over recent decades, and what their unfolding could mean for world economies going forward.

Background

Central banks around the world haven’t shied from claiming responsibility for low and stable inflation over recent decades. Inflation has indeed remained low, averaging around 2.4 per cent per year in Australia over the past 30 years. In stark contrast, the yearly average was closer to 9 per cent over the preceding 20-year period.

However, central banks didn’t simply become better at implementing monetary policy – global demographic changes over recent decades provided a one-off, disinflationary ‘dividend’ that dictated the path of inflation and interest rates. What is more important, however, is what happens when this sweet spot turns sour. In recent years, we have already started getting a taste of what is to come.

History of the labour force and the global economy

A few years after the Berlin Wall fell in 1989, Boris Yeltsin reintegrated much of Eastern Europe into the global work force. In 2001, the integration of China into the global manufacturing complex followed their inclusion in the World Trade Organisation (WTO). With thanks to globalisation and aided by former US president Bill Clinton, the result of these events was a doubling in the effective labour force for the world’s advanced economies from 1991 to 2018. Similarly, a spike in the global labour force due to the integration of workers in China and Eastern Europe has set a trend of low inflation and interest rates over the past 30 years.

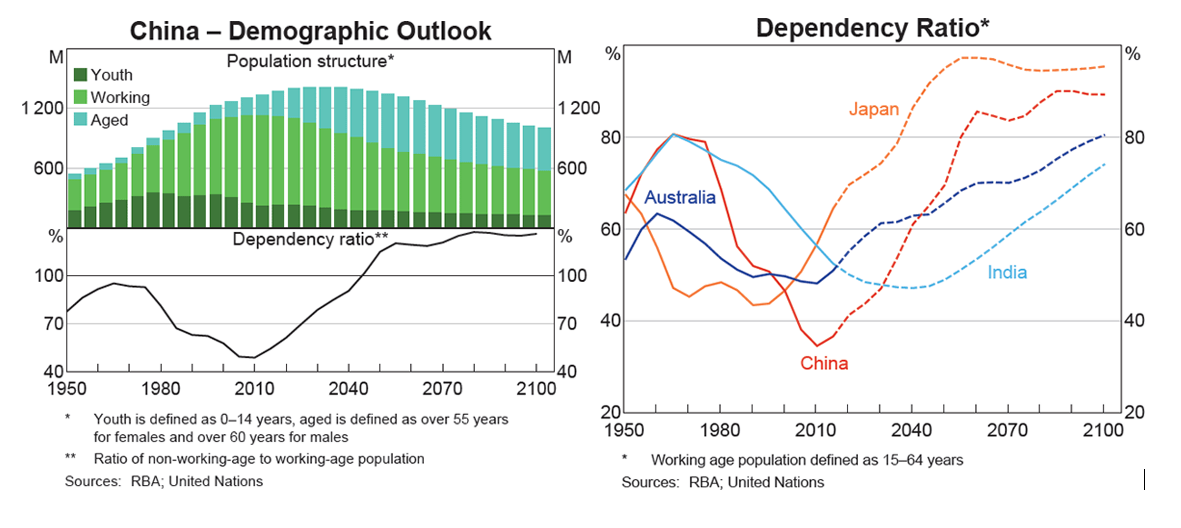

While the world has enjoyed a burgeoning labour force, this trend is set to invert. This is most easily measured by the ratio of non-working age to working age population, otherwise known as the dependency ratio. A high dependency ratio indicates that those of working age, and the overall economy, need greater resources to support an older population.

Ultimately, the global labour force is set to decline, as displayed in the above graphics, due to a large number of the population exiting the work force. The Demographic Outlook graph (left) displays the historical and projected makeup of demographics in China in three groups: the sum of the population under 15 years of age, 15 to 64 years of age, as well as 65 and over. The data shows us that as the sum of those aged under 15 and those over 65 years old increases, so does the dependency ratio - seen in the lower section of the graph.

The second graph (right) shows the historic and projected dependency ratio of different countries. Japan’s ageing population is well-known, and the data shows China may be on a similar trajectory.

China’s trajectory is important to analyse. As a primary driver of low global inflation over previous decades due to a massive workforce, demographics alone will no longer provide this tailwind as the population ages - China’s demographics could become a headwind, with a global effect.

How does an ageing population affect inflation?

A shrinking work force leads to greater bargaining power for workers, and therefore wages growth, a natural driver of inflation. On top of this, even greater pressure is placed on wages growth if taxes rise to meet additional government expenditure required on health and pension systems. At the same time this is happening, the non-working age population will begin drawing down on their savings to pay for essential goods and services. When combined, these circumstances could lead to a higher average rate of inflation than we have become comfortable with in the previous three decades.

Disinflationary measures

There are some forces that could keep a lid on inflation. Increases in productivity through technological developments, especially considering the rise of artificial intelligence and automation, would be disinflationary. So too would an increase in the number of individuals choosing to delay retirement and remain in the work force, whether for financial or social reasons.

As the ageing population require a greater share of resources, higher inflation could return as a primary challenge for central banks.

How could investors navigate this environment?

At BDO, we are forward-thinking when constructing investment portfolios for clients. There are several things an investor can consider to prevent risk in an inflationary environment, including:

- Returns from defensive investments - such as floating rate bonds - look more attractive in a higher interest rate environment, as does private credit

- Shares in technology companies have fallen out of interest for many investors, though there is an argument that these companies will lead the way for growing productivity in the face of a declining work force

- Utilising professional investment managers with a capability of identify opportunities and consistently outperform the market will become even more important moving forward

- Infrastructure companies – those that operate assets such as toll roads, for instance - often have contractual agreements to increase their earnings by the rate of inflation

- Strategies where success is not tied directly to prevailing economic conditions can be a source of returns and portfolio diversification.

When faced with concerns or anxiety over market impacts on your investments, seek professional financial advice for your personal circumstances. For support in making the right decisions for your portfolio and keeping on track through market highs and lows, reach out to your local BDO Private Wealth adviser.

This publication has been carefully prepared, but it has been written in general terms and should be seen as broad guidance only. The publication cannot be relied upon to cover specific situations and you should not act, or refrain from acting, upon the information contained therein without obtaining specific professional advice. Please contact the BDO member firms in Australia to discuss these matters in the context of your particular circumstances. BDO Australia Ltd and each BDO member firm in Australia, their partners and/or directors, employees and agents do not accept or assume any liability or duty of care for any loss arising from any action taken or not taken by anyone in reliance on the information in this publication or for any decision based on it.

BDO Private Wealth Advisers Pty Ltd ABN 62 805 149 677 AFS Licence No. 238280 is a member of a national association of separate member firms which are all members of BDO Australia Ltd ABN 77 050 110 275, an Australian company limited by guarantee. BDO Private Wealth Advisers Pty Ltd and BDO Australia Ltd are members of BDO International Ltd, a UK company limited by guarantee, and form part of the international BDO network of separate member firms. Liability limited by a scheme approved under Professional Standards Legislation.

BDO is the brand name for the BDO network and for each of the BDO member firms.

© 2023 BDO Private Wealth Advisers Pty Ltd. All rights reserved.