The role of voluntary and mandatory sustainability reporting

The role of voluntary and mandatory sustainability reporting

Our sustainability webinar series aims to break the complex world of sustainability down into digestible pieces to help you get on top of the fundamentals and start driving change in your organisation. At our June 2024 event, Aletta Boshoff outlined essential steps and resources to guide organisations through the transition from strategic voluntary reporting to mandatory compliance.

The countdown begins: As the global push for climate action intensifies, jurisdictions worldwide are increasingly adopting mandatory climate disclosure requirements. The once-voluntary practice is being transformed into a legal obligation. For most organisations, the journey begins with data. You should already be considering how to obtain your data, support and capabilities and start keeping the necessary records now.

Navigating climate reporting: From voluntary to mandatory

Mandatory climate reporting will not begin before January 2025 for large entities and asset managers (with more than $5 billion under management).

Nearly 75% of the ASX200 have already taken a proactive stance and committed to or voluntarily reported climate-related information following the Task Force on Climate-Related Financial Disclosures (TCFD) guidelines. Their disclosures cover aspects such as emissions reduction strategies, climate risks, and resilience planning.

If your organisation follows these guidelines, the Australian Securities and Investments Commission (ASIC) believes it will be well-prepared to report under any future mandatory reporting regime. This is especially true because the International Sustainability Standards Board’s (ISSB) IFRS® Sustainability Disclosure Standards align with the four pillars of the TCFD framework.

Companies can also benefit by engaging with the IFRS Sustainability Standards during the voluntary report preparation process to assess their capabilities, data availability and requirements against the new standards.

How do voluntary and mandatory reporting interact?

CFOs and finance teams are responsible for mandatory reporting. They must prepare financial statements in accordance with IFRS® Accounting Standards. When something is mandatory, it’s typically on their desk—no exceptions.

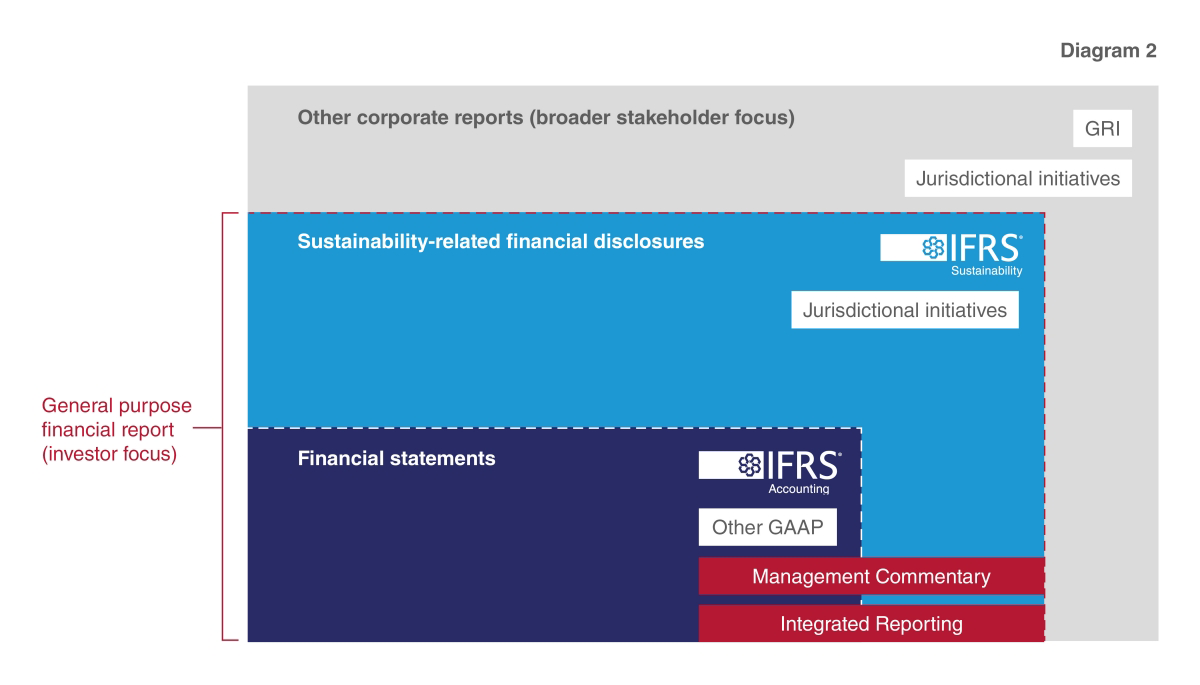

At a high level, the below diagram shows how integrating sustainability reporting with financial reporting bridges the gap between the voluntary and mandatory sustainability reporting requirements, ensuring transparency and accountability.

- The blue blocks represent the annual report and mandatory sustainability disclosures, which are the cornerstone of financial transparency and are publicly available through various channels, e.g., the Australian Securities Exchange (ASX) and ASIC.

- The grey block encompasses voluntary disclosures, which come in diverse frameworks, such as the Global Reporting Initiative (GRI) and SASB® Standards. These disclosures often exist separately from the annual report, reflecting sustainability efforts beyond legal requirements.

Over the next decade, we anticipate significant changes as mandatory standards expand, the grey block shrinks, and more voluntary disclosures integrate into the annual report. The goal? A unified general purpose financial statement where sustainability and financial data coexist seamlessly.

Source: IASB diagram 2

Source: IASB diagram 2

Getting started with the first two pillars of the TCFD framework

For many organisations, voluntary compliance with the Task Force on Climate-related Financial Disclosures (TCFD) framework is a crucial foundation for readiness when mandatory reporting is implemented in Australia.

While full compliance straight away may be ambitious, focusing on the first two pillars, Governance and Strategy, as a minimum, will put your organisation in good stead. The year after, expand to Risk Management, then Metrics and Targets.

Governance |

Strategy |

Risk Management |

Metrics and Targets |

|

Disclose the organization's governance around climate-related risks and opportunities. |

Disclose the actual and potential impacts of climate-related risks and opportunities on the organization's businesses, strategy, and financial planning where such information is material. |

Disclose how the organization identifies, assesses, and manages climate-related risks. |

Disclose the metrics and targets used to assess and manage relevant climate-related risks and opportunities where such information is material. |

|

RECOMMENDATIONS |

|||

|

a) Describe the board's oversight of climate-related risks and opportunities. |

a) Describe the climate-related risks and opportunities the organization has identified over the short, medium, and long term. |

a) Describe the organization's processes for identifying and assessing climate-related risks. |

a) Disclose the metrics used by the organization to assess climate-related risks and opportunities in line with its strategy and risk management process. |

|

b) Describe management's role in assessing and managing climate-related risks and opportunities. |

b) Describe the impact of climate-related risks and opportunities on the organization's businesses, strategy, and financial planning. |

b) Describe the organization's processes for managing climate-related risks. |

b) Disclose Scope 1, Scope 2, and, if appropriate, Scope 3 greenhouse gas (GHG) emissions, and the related risks. |

|

|

c) Describe the resilience of the organization's strategy, taking into consideration different climate-related scenarios, including a 2°C or lower scenario. |

c) Describe how processes for identifying, assessing, and managing climate-related risks are integrated into the organization's overall risk management. |

c) Describe the targets used by the organization to manage climate-related risks and opportunities and performance against targets. |

By combining mandatory IFRS S1 and S2 reporting with voluntary GRI disclosures, your organisation can align closely with the European Sustainability Reporting Standards (ESRS). These 12 standards provide a robust framework for comprehensive sustainability reporting.

We’re here to help

Don’t be afraid of the unknown – start your sustainability journey today. We offer plenty of information and tools to assist you. If you’re unsure where to begin, reach out to our national team of sustainability experts who have been helping clients tackle their sustainability transformations.