Australia's new climate disclosure rules are here - is your organisation prepared?

Australia's new climate disclosure rules are here - is your organisation prepared?

As of 1 January 2025, Australia’s climate-related financial disclosure standards are in effect, marking a significant shift in corporate reporting.

To help organisations meet these evolving obligations, our sustainability team has developed the Climate-related Disclosures AASB S2 checklist, a practical resource designed to help you assess compliance, identify gaps and prepare audit-ready disclosures.

Aligned with the four key pillars: Governance, Strategy, Risk Management, and Metrics and Targets, and incorporating general requirements from AASB S1, this checklist enables you to:

- Assess compliance with all 149 disclosure requirements under AASB S2 and S1

- Identify gaps in your climate-related disclosures

- Build confidence ahead of your first mandatory reporting period.

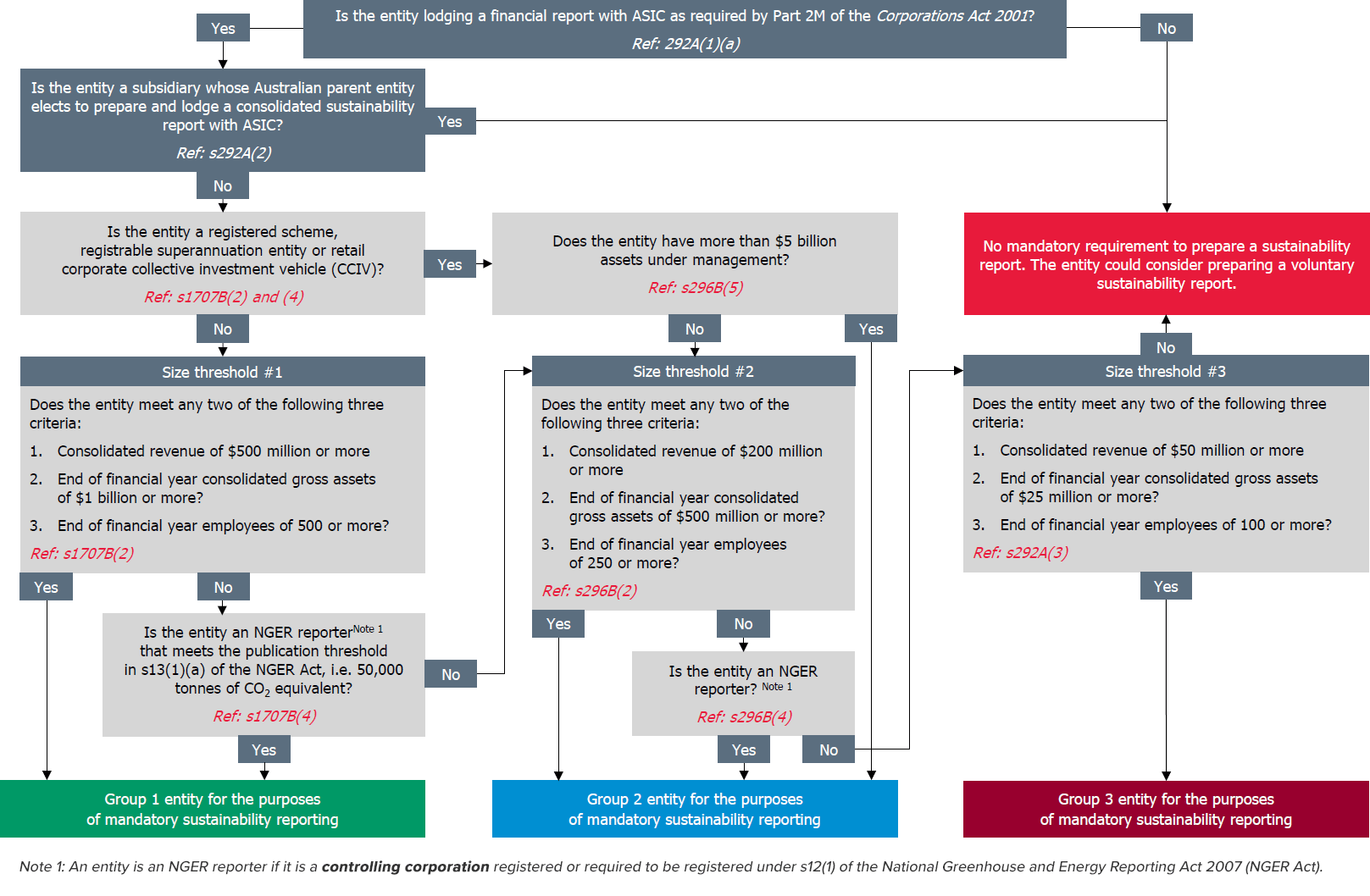

This checklist is designed for Group 1, 2 or 3 entities preparing for mandatory climate disclosures, or those voluntarily aligning with AASB S2.