Accounting for business combinations – the acquisition method

With the deadline for moving to general purpose financial reporting approaching fast, entities need to be familiar with all the recognition and measurement requirements of Australian Accounting Standards because general purpose financial statements (GPFS) require the application of all Australian Accounting Standards. With this in mind, Accounting News is tackling one topic at a time.

- Six accounting surprises when buying a business (April 2021)

- Consolidated financial statements – when are they required? (May 2021)

- Accounting for joint arrangements (June 2021)

- Accounting for associates (July 2021)

- Fair value measurement (August 2021)

- When is the acquisition of a business accounted for as a business combination (September 2021).

Which Accounting Standard applies?

IFRS 3 Business Combinations is the Accounting Standard that describes the appropriate accounting treatment for ‘business combinations’.

What is a business combination?

A ‘business combination’ is a transaction where an acquirer obtains control of one or more ‘businesses’. Last month’s article explains how to identify whether you have acquired a business, or simply have an asset acquisition.

Asset acquisitions vs business combinations

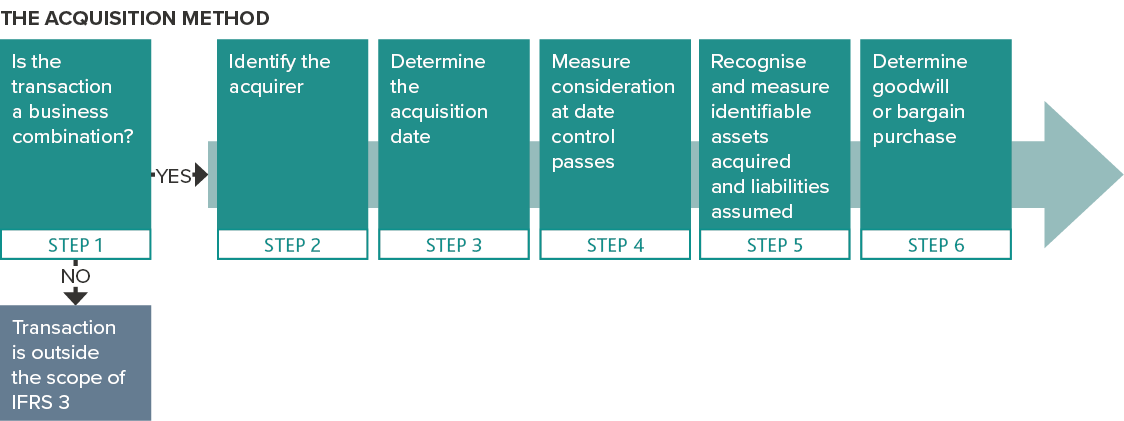

It is important to assess upfront if you have acquired a business or merely assets. If you have an asset acquisition, you will allocate the fair value of the purchase consideration to individual identifiable assets acquired (including intangible assets meeting the definition and recognition criteria in IAS 38 Intangible Assets) and liabilities assumed, on a relative fair value basis. However, if you have a business combination, you will need to apply the acquisition method contained in IFRS 3.

What is the acquisition method?

IFRS 3 requires the acquirer in a business combination to account for a business combination using the acquisition method. The acquisition method involves steps 2 to 6 as shown in the diagram below.

Step two: Identify the acquirer

As a starting point, one of the combining entities in the business combination is identified as the acquirer. The acquirer is the entity that obtains control of another entity and IFRS 10 Consolidated Financial Statements is the Accounting Standard that provides guidance on when one entity controls another.

IFRS 10, paragraphs B14-B18 contain additional factors to consider when it is not obvious which entity obtained control, for example, where rights other than ownership or voting rights may determine which entity has control.

Reverse acquisitions

The acquirer is not necessarily the legal parent. Sometimes, a legal subsidiary (usually a large trading entity or group) will be the acquirer if it merges with a smaller entity that is the legal parent. These are referred to as ‘reverse acquisitions’, and it will be the legal subsidiary (accounting acquirer) that applies the acquisition method of business combination accounting.

Step three: Determine the acquisition date

The acquisition date is the date on which the acquirer obtains controls of the acquiree. This is generally the ‘closing date’, or date when the acquirer legally transfers the consideration and acquires the assets and assumes the liabilities of the acquiree. Judgement is required to determine the acquisition date when the acquirer starts running the business of the acquiree before the closing date. This fact alone does not necessarily mean that acquisition date is the earlier date.

Step four: Measure consideration

The consideration transferred by the acquirer is measured at fair value at the date control passes. Consideration comprises the sum of the acquisition date fair value of:

- Assets transferred by the acquirer

- Liabilities incurred by the acquirer to former owners

- Equity issued by the acquirer.

An exception to this ‘fair value’ requirement is for replacement share-based payment awards issued by the acquirer to the acquiree’s employees, where that consideration is included in consideration transferred for the business combination. In such cases, these are measured by applying IFRS 2 Share-based Payment using a market-based measure.

The consideration transferred may include cash, other assets, a business or a subsidiary of the acquirer, deferred consideration, contingent consideration, ordinary or preference shares, options and warrants.

Deferred consideration vs contingent consideration

Both deferred and contingent consideration are included in the total consideration for the business combination. Deferred consideration is unconditional and must be paid at a future date, whereas contingent consideration is subject to estimation uncertainty because future payments may or may not be made, depending on whether certain key performance indicators are met.

Consideration in a reverse acquisition

Determining the consideration in a reverse acquisition can be tricky because we effectively are applying ‘upside down’ accounting. The value of the consideration transferred is based on the number of equity instruments that the accounting acquirer (legal subsidiary) would have had to issue to the owners of the accounting acquiree (legal parent) in order to give the owners of the legal parent the same percentage of equity interests in the combined entity that results from the reverse acquisition.

Acquisition-related costs

Acquisition-related costs such as finders’ fees, legal fees, advisory fees, accounting fees, valuation fees, etc. do not form part of the consideration transferred. They are expensed as incurred.

Step five: Recognise and measure identifiable assets acquired and liabilities assumed

This step, often referred to as the ‘purchase price allocation’, can be a long, complex and expensive process because fair valuations need to be obtained.

At acquisition date, the acquirer recognises, separately from goodwill, all identifiable assets acquired, all liabilities assumed, as well as any non-controlling interests in the acquiree. This could result in the acquirer recognising assets and liabilities that the acquiree has not recognised in its own financial statements (e.g. brand names, patents, customer relationships and contingent liabilities).

Identifiable assets acquired and liabilities assumed are only recognised if they meet the definition of an asset or liability at acquisition date. Therefore, plans to restructure the acquired business, or terminate the acquiree’s employees, are not included as part of the liabilities assumed, but rather as post-combination expenses.

The acquirer must also pay attention to what was acquired or settled as part of the business combination, and what was a result of a separate transaction, for example:

- Settling a pre-existing relationship between the acquirer and the acquiree

- Remunerating employees or former owners of the acquiree for future services

- Reimbursing the acquiree or former owners for paying the acquirer’s acquisition-related costs.

Finally, acquirers need to ensure that all assets and liabilities recognised are properly classified or designated based on contractual terms at the acquisition date.

Measurement

Identifiable assets acquired and liabilities assumed are generally recognised at their acquisition date fair values, however, there are a few exceptions, such as for measuring income taxes, employee benefits, leases, certain share-based payment transactions and assets held for sale, which are accounted for in accordance with the requirements of the specific standards identified in IFRS 3.

Non-controlling interests are measured at either:

- Fair value, or

- The acquiree’s proportionate share in the recognised amounts of the acquiree’s identifiable net assets.

Step six: Determine goodwill or bargain purchase price

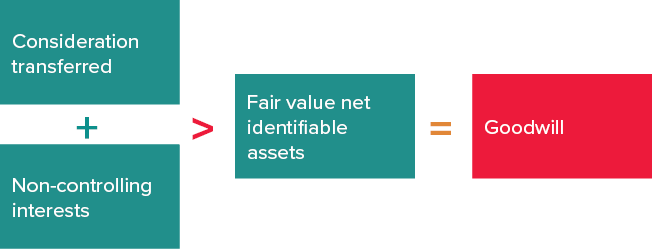

Where control is obtained in a single transaction, goodwill is essentially the excess of:

- The consideration transferred and non-controlling interest in the acquiree, over

- The fair value of the net identifiable assets at acquisition date.

If the opposite is true, i.e. (b) exceeds (a), we have a gain on bargain purchase, which is recognised in profit or loss, but only after a careful check that the acquirer has identified all assets acquired and liabilities assumed, and that the above components have been appropriately measured.

The measurement period

If the acquisition date is close to year-end, acquirers may not have enough time to complete all the valuations required to compile the business combination acquisition journal entry. For example, valuing identifiable assets as well as consideration transferred (including contingent consideration) may require independent valuation expertise. For this reason, IFRS 3 allows a measurement period that cannot exceed one year from the acquisition date, but ends as soon as the entity has obtained all the fair value information to complete the business combination accounting.

The acquirer can apply ‘provisional accounting’ at any reporting date falling within the measurement period to items where valuations are still outstanding. Such provisional amounts are then retrospectively adjusted at later reporting dates once valuations have been finalised.

Additional assets and liabilities may also be identified and recognised during the measurement period if new information is obtained about facts and circumstances that existed at acquisition date. These amounts are also adjusted retrospectively.

Measurement period adjustments will increase or decrease the balance of goodwill. For example, if the provisional amount recognised for a brand name increases by $100,000, the balance of goodwill will decrease by $100,000.

Retrospective adjustments are made to prior reporting periods where provisional amounts recognised in one reporting period are firmed up in another.

Example:

Acquirer acquired Acquiree on 1 January 2021 (year-end is 30 June 2021). Acquirer provisionally assigned a value of $100,000 to customer relationships, with an estimated useful life of five years. On 28 February 2022, the fair value of customer relationships was independently assessed at $200,000. In the 30 June 2022 financial statements, the following retrospective adjustments are required to the 30 June 2021 comparatives as measurement period adjustments:

- Customer relationships should be recognised at $200,000 instead of $100,000 on 1 January 2021

- Goodwill will decrease by $100,000, and

- Amortisation from acquisition date to 30 June 2021 should be increased in profit or loss from $10,000 to $20,000 (i.e. $200,000/5 X 6/12).

Preparers should take care to ensure that errors are accounted for as such and not lumped in with measurement period adjustments.

Other complex areas

If you have a business combination achieved in stages (sometimes referred to as a ‘step acquisition’) or have a business combination where there is no consideration, please refer to IFRS 3 for more guidance. IFRS 3 also contains detailed requirements on the subsequent measurement and accounting for items such as reacquired rights, contingent liabilities, indemnification assets and contingent consideration.

Need assistance?

In practice, assessing whether a transaction is a business combination can be extremely complex and judgemental, and determining the appropriate accounting using the acquisition method is also not easy. Please contact BDO’s IFRS Advisory team if you require assistance.

More information

Additional resources are available on this topic, including our:

- Virtual workshop on Business combinations - IFRS 3 - please contact Aletta Boshoff if you would like to purchase the recorded materials

- IFRS in Practice, Distinguishing between a business combination and an asset purchase in the extractives industry

- Webinar - Asset acquisition vs business combination? Changes to IFRS 3 Business Combinations.