What’s hot in 2023 for CFOs and finance teams

What’s hot in 2023 for CFOs and finance teams

The deteriorating economic conditions and geopolitical uncertainties we saw in 2022 continue to impact businesses during 2023. There are several ‘hot’ issues that are likely to impact CFOs from a strategic perspective, and also their finance teams who must apply appropriate accounting in this uncertain economic environment. Some of these ‘hot’ issues or challenges include:

- A looming recession – earnings pressures and need to optimise cost structures

- Inflationary pressures

- Exorbitant energy prices

- Rapidly increasing interest rates

- Continued supply chain issues

- A persistent skills shortage

- The need for additional capital

- Ability to obtain new finance or refinance existing loan facilities.

What’s hot for CFOs?

As a result, the top three priorities for CFOs from a strategic perspective are likely to be the following:

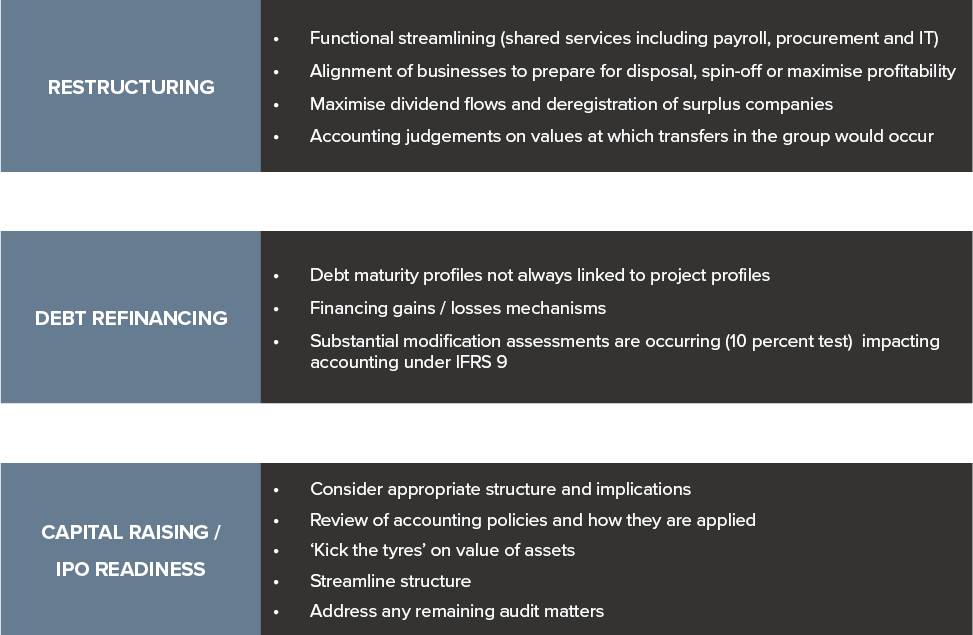

Restructuring

Functional restructuring may be required or desirable for your business to reduce the organisation’s cost structure and obtain efficiencies, including adopting a shared services model for payroll, procurement and IT. We are also seeing CFOs looking at how to align businesses to prepare for a disposal or spin-off, or merely to maximise profitability. In this regard, any restructuring should maximise dividend flows and enable deregistration of surplus companies.

Debt financing

Given the current state of the economy, many CFOs will be looking to refinance their borrowings, either to obtain better terms, or because their existing financier is looking to de-risk its loan book. In addition, debt maturity profiles for long-dated projects may require refinancing during 2023 because the maturity profile does not always line up with the timeline for project construction. Given the higher interest rate environment, we expect financiers to make businesses ‘jump through hoops’ to obtain new and extended finance, including meeting stringent covenants, and also ESG benchmarks.

Capital raising/IPO readiness

In order to prepare for a capital raising or IPO, CFOs should consider the appropriate structure and implications, including tax and accounting. Regardless of whether you are looking at private or public capital, make sure your house is in order.

All accounting policies should be reviewed to ensure they comply with the recognition and measurement requirements of IFRS, especially for complex areas such as accounting for complex financial instruments, share-based payments, business combinations and revenue recognition. And don’t forget to ‘kick the tyres’ on asset values and consider alternative structures for an IPO to achieve the best outcome in financial reporting.

Also remember - capital providers will want to see audited financial statements, so make sure you are audit ready.

Focus on energy

Some industries are more sensitive to increasing energy prices than others, but few are immune. In addition, CFOs will need to ensure new projects consider transition to green energy and are also still viable.

CFOs should consider the impact of entering into Power Purchase Arrangements (PPAs) to ensure energy security. Accounting for these can be complex. Depending on the structure of the agreements, PPAs can include embedded derivatives and have a big impact on optimal balance sheet structure.

What’s hot for the finance team?

The biggest challenge facing finance teams during 2023 is that they will be accounting for transactions and balances during a period of unprecedented uncertainty. The good old days of low interest rates and low inflation are over, and finance teams must contend with how the following will affect their finance statements:

- Ongoing war and unrest between Russia and Ukraine

- Rising energy prices

- Supply shortages

- Inflation

- Interest rate and exchange rate volatility.

BDO has produced a publication - Accounting in Times of Uncertainty that discusses some of the implications and considerations for entities when preparing financial statements for the year ended 31 December 2022 and beyond. Finance teams need to consider:

- Going concern

- Judgements, estimates and estimation uncertainties

- Impairment of non-financial assets

- Discount rates

- Events after the reporting period

- Assessment of control, joint control and significant influence

- Effects of inflation

- Financial instruments

- Disclosures.

We recommend finance teams review the detailed discussion on all of the above in our publication. However, we would like to point out some key takeaways you may not have considered previously.

Disclosing estimation uncertainty

This continues to be a focus area for the Australian Securities and Investments Commission (ASIC). Many entities provide minimal detail quantifying key assumptions that have a significant risk of resulting in a material adjustment to the carrying amounts of assets or liabilities in future periods. Providing less information may actually result in more questions from ASIC. Our publication sets out expectations of regulators with regard to disclosure of estimation uncertainty:

| Regulator expectations |

| Clearly specify which estimates have a significant risk of material adjustment to the carrying amount of assets and liabilities in the next financial year. |

| Clearly distinguish the disclosure of other estimates, and associated sensitivities, from significant estimates and explain their relevance. |

| Quantify the specific amount at risk of material adjustment (i.e. the carrying amount). |

| Provide sufficient granularity in the descriptions of assumptions and/or uncertainties to enable users to understand management’s most difficult, subjective or complex judgements. |

| Provide meaningful sensitivities and/or ranges of reasonably possible outcomes for significant estimates. For example, sensitise the most relevant assumptions, and choose alternate assumptions that are considered reasonably possible. |

| Quantify the assumptions underlying significant estimates when investors need this information to fully understand their effect. |

| Explain any changes to past assumptions if the uncertainty remains unresolved. |

| Sources of estimation uncertainty and the related disclosures should be updated at the balance date. |

Discount rates

Discount rates used in the past may no longer be appropriate given recent interest rate increases in Australia. The requirements for determining the discount rate varies between IFRS Standards, as shown in the table below.

|

IFRS Standards |

Discount rate |

|

IAS 36 Impairment of Assets |

Pre-tax rate that reflects current market assessment of the time value of money and the risks specific to the asset for which cash flow estimates have not been adjusted. |

|

IAS 19 Employee Benefits |

Market yields on high quality corporate bonds. For currencies for which there is no deep market in high quality corporate bonds, the market yields on government bonds denominated in that currency shall be used. |

|

IFRS 16 Leases |

Incremental borrowing rate (when the interest rate implicit in the lease cannot be readily determined). Refer to our article - What recent interest rate increases mean for discount rates used for lease accounting for more information. |

|

IAS 37 Provisions, Contingent Liabilities and Contingent Assets |

Pre-tax rate that reflects current market assessment of the time value of money and the risks specific to the liability for which cash flow estimates have not been adjusted. |

|

IFRS 2 Share-based Payment |

Risk-free rate used in option pricing models such as Black-Scholes (following the principles in IFRS 13 Fair Value Measurement). |

When determining the appropriate discount rate:

- Avoid double counting – if cash flow estimates are adjusted for certain risks, the discount rate should not also reflect that risk

- Where pre-tax discount rates are required, simply grossing up a rate derived from weighted average cost of capital (WACC) may not give you the right answer, particularly in complex scenarios or where multiple tax rates are involved

- If using nominal cash flows, which include the effect of inflation, use a discount rate that includes the effect of inflation

- You may need to involve a specialist to help you determine an appropriate rate

- Provide clear, entity-specific disclosure as to how the discount rate was determined, including assumptions used.

Effects of inflation

Given that most major economies have experienced rising inflation over the past year, finance teams need to be cognisant that the following areas could be affected:

| Accounting area | Implication of rising inflation |

| Discount rates | As noted above, the discount rate may be impacted by rising inflation. |

| Share-based payments | Inflation may lower demand for goods and services, and poorer performance may mean that the likelihood of achieving internal performance conditions may be reduced. |

| Derivatives | Inflationary clauses embedded in revenue or supply contracts may need to be separated and accounted for as a derivative. |

| Expected credit loss calculations | Rising inflation may lead to an increase in the risk of default. |

| Debt modifications | An increase in the occurrence of these are expected and will require application of the ’10 percent test’ to determine whether there has been a substantial modification for accounting purposes. |

| Leases |

Variable lease payments dependent upon inflation requires remeasurement of lease liabilities. Any modifications to lease contracts as a result of inflationary pressures requires a reassessment of the incremental borrowing rate used to discount the lease liability. |

| Inventories | Estimated costs necessary to make a sale are expected to increase and this could result in higher inventory obsolescence if higher costs are not passed on to customer through higher selling prices. |

| Employee benefits | Inflation affects actuarial assumptions used to measure defined benefit plans and other long-term employee benefits, such as assumptions about future salary increases and discount rates. |

| Government grants | Governments may provide below-market interest rate loans which need to be accounted for under IAS 20 Accounting for Government Grants and Disclosure of Government Assistance. |

| Impairment of assets | Higher discount rates lower the value of assets or cash-generating units which may be a possible indicator of impairment and entities need to reassess their estimated cash flows used in value in use calculations. |

| Provisions | Contracts may become onerous due to increasing costs without a corresponding increase in revenues, for example, in the case of long-term fixed rate revenue contracts. IAS 37 was recently amended to clarify which costs are included when assessing whether a contract is onerous. Please refer to our recent article for more detail. |

More information

For more information on what’s hot and not, and accounting in times of uncertainty, please watch our recent webinar - What's Hot and Not in 2023 and refer to our publication - Accounting in Times of Uncertainty.

Public sector

In the public sector, two ‘hot’ areas are fair value measurement for public sector entities, and service concession arrangements.

Public sector entities have experienced difficulty applying IFRS 13 Fair Value Measurement to certain public sector assets, particularly those with restrictions, and also concessionary (peppercorn) leases. In December 2022, the Australian Accounting Standards Board (AASB) issued amendments to IFRS 13 to clarify certain aspects of fair value accounting by the public sector.

AASB 1059 Service Concession Arrangements: Grantors is effective for years commencing on or after 1 January 2020. It has had a significant impact on the timing of recognition of service concession assets and liabilities, with a service concession asset and either a financial liability, or a grant of right to the operator (GORTO) liability, recognised progressively during the course of construction of the service concession asset, rather than on completion. Earlier recognition of service concession assets can affect government performance measures.

The AASB is currently seeking comment on AASB 1059 via its invitation to comment, ITC 49 Post-implementation Review of AASB 1059 Service Concession Arrangements: Grantors. Comments are due by 28 February 2023. Please refer to our October 2022 Corporate Reporting Insights article for more information – Post-implementation review of accounting for service concession arrangements by grantors (AASB 1059).

Not-for-profit entities

Not-for-profit entities should also note that the AASB is seeking feedback by 31 March 2023 on:

- ITC 50 Post-implementation Review – Income of Not-for-profit Entities

- ITC 51 Post-implementation Review of Not-for-Profit Topics – Control, Structured Entities, Related Party Disclosures and Basis of Preparation of Special Purpose Financial Statements

- Discussion Paper Development of Simplified Accounting Requirements (Tier 3 Not-for-Profit Private Sector Entities). Our previous article contains a summary of these proposals.

Need assistance?

Please contact our IFRS & Corporate Reporting team if you require assistance with any financial reporting matters during 2023.