ASIC focus areas for 30 June 2022 financial reports

ASIC focus areas for 30 June 2022 financial reports

The Australian Securities and Investments Commission (ASIC) recently issued a Media Release highlighting its focus areas for 30 June 2022 reporting. It is urging directors and preparers of 30 June 2022 annual and half-year financial reports to assess whether these provide useful and meaningful information for investors and other users.

Five focus areas

As part of its financial reporting surveillance program, ASIC reviews financial reports of a selection of listed and other public interest entities. The Media Release highlights five areas that ASIC will focus on when it conducts these reviews:

- Asset values

- Provisions

- Solvency and going concern assessments

- Subsequent events

- Disclosures in the financial report and the Operating and Financial Review (OFR).

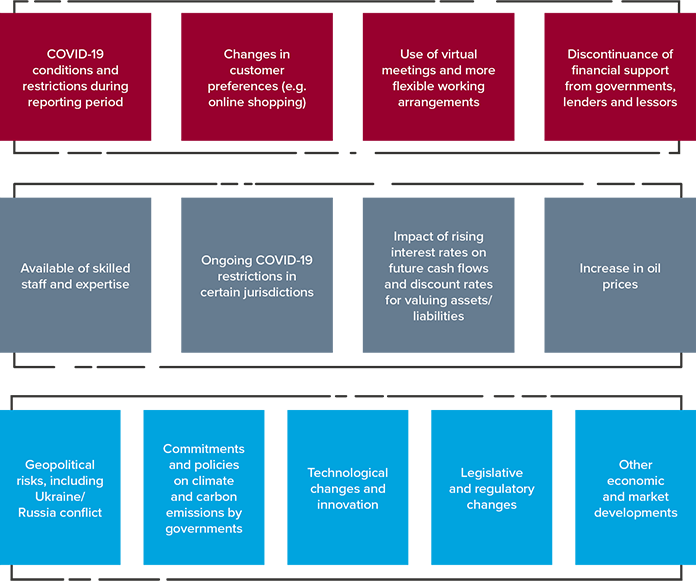

While the immediate effects of COVID-19 may have subsided, entities continue to face changes in circumstances and uncertainties about future economic and market conditions, which may impact their business strategies and future financial performance. These uncertainties should be factored into the assumptions used for financial reporting purposes, and should be reasonable and supportable. Examples of changes in circumstances, uncertainties, and risks to be considered when preparing 30 June 2022 financial reports include those listed in the diagram below. This list is not exhaustive.

Asset values

ASIC’s focus on asset values relates to the following areas.

|

Financial statement area |

Focus areas |

|

Impairment of non-financial assets |

|

|

Values of property assets |

Note: Refer to our Lease Accounting webpage for more information about the complexities of lease accounting, including software solutions, training materials, and publications. |

|

Expected credit losses (ECL) on loans and receivables |

|

|

Value of other assets |

|

Provisions

While the need to consider adequacy of provisions for onerous contracts, financial guarantees given, and restructuring are consistent with focus areas noted previously, ASIC has added the following provisions to its list:

- Leased property make good provisions

- Mine site restoration provisions.

Solvency and going concern assessments

Entities should consider factors affecting the business which could impact the entity’s solvency and going concern assessment. These were highlighted in the diagram above.

Subsequent events

Entities should review events occurring after the end of the reporting period, in order to determine whether these are ‘adjusting’ or ‘non-adjusting’ post-balance date events.

Disclosures in the financial report and OFR

Lastly, entities should focus on ensuring adequate disclosures as outlined in the table below.

|

Consider |

Focus areas |

|

General considerations |

|

|

Disclosures in financial report |

|

|

Disclosures in OFR |

Note: The Media Release notes that disclosing an exhaustive list of genetic risks that might potentially affect a large number of entities is not helpful. It emphasises that the OFR should include a discussion on environmental, social and governance (ESG) risks, and these risks should be described in context. For example, it could include discussion about:

|

|

Assistance and support by government and others (e.g. lenders and landlords) |

|

|

Non-IFRS financial information |

|

|

Disclosure in half-year financial reports |

|

Need assistance?

Please contact our IFRS Advisory team if you need support with any financial reporting matters for your 30 June 2022 financial reports.